A Meta Way Forward

Unless you’ve been living under a rock (which actually sounds like a viable alternative compared to 2021), then you’ll have heard that Mark Zuckerberg decided to make the bold move in changing Facebook’s name to Meta Platforms.

Not an entirely shocking move considering Facebook do so much more than just provide a platform for your well-intended aunty from Maidenhead who’ll share a missing cat post from Melbourne.

Since their first investment in 2005 for the domain name facebook.com for $200,000 (previously thefacebook.com), Meta Platforms has gone on to make a further 78 deals (of which 27 of these are disclosed and account for $23bn).

The big ones you’ll likely be familiar with, such as Instagram (which interestingly started out as ‘Burbn’, a bourbon photo and location sharing app) and Whatsapp.

But failing to look beyond the big 3 components would be facile if we’re to truly understand the Meta Platforms future and appreciate their true ambitions.

For instance there’s also CRTL-Labs, a neuro interface start-up which creates wrist bands that’ll transmit electrical signals from the brain to a computer. This will allow mere muggles to control robots, machinery and computer input from a flick of the wrist.

*You laugh now…

Another notable name not to forget is Oculus VR which Zuckerberg purchased in 2014 for a cool $2bn.

If you’re not familiar with the workings of Oculus VR, then it’s a piece of hardware which allows the user to enter a world of virtual reality by way of headset. Once the headset is fixed on, you’ll be cocooned from the real world and submerged into whatever virtual existence of your choosing – be it a battle to the death with Darth Vader or a David Attenborough narrated quest through the deep sea. Either way, you’ll be left utterly emersed into whichever altered reality you pick.

*I think the living under a rock way of life might have just been pushed into second place now*

After the initial pomp and ceremony, Oculus VR remained a largely unspoken acquisition – that is until recently however. Their prevalence might arrive sooner rather than later with daily active users up 90% on Christmas Day 2021 YoY and one of the top 5 most downloaded apps on that day.

Oculus VR is part of their non-core advertising business and is grouped as ‘other’ which only accounts for 3% of their overall total revenue. But that insignificant 3% figure will become increasingly significant based on its current trajectory.

Just as you’ll hear fellow market participants howl that Facebook and Instagram are ‘dead’, Zuckerberg has been quietly assembling an army of acquisitions for their next phase of growth.

I haven’t even mentioned the 100+ granted applications to the US Patent and Trademark office which reveal the extent of their technological scope. Many of which consist of biometric analytical data patents to allow personalised avatars to better replicate that of their human user.

When we combine some of these elements, one can almost start to get a tangible idea of what the Metaverse might look like.

Part video game, part communication tool, part escapism, part avatar and part… who knows.

The tricky part is being able to forgive our own ignorance and understand the Metaverse way of living is still in its infancy. We’re still only at the tip of the iceberg when trying to capture Meta Platform’s total addressable market for the foreseeable future, but an early blueprint is at least visible.

With this in mind, I can’t help but think back to an interview between a slightly condescending and highly sceptical David Letterman and a very polite Bill Gates on the David Letterman show in 1995.

DL - “What about this internet thing?”

After a patient and dumbed down brief explanation from Bill Gates as to what the internet is;

DL – “I can remember a couple of months ago there was like a big breakthrough announcement that

on the internet or some computer deal, they were going to broadcast a baseball game. You could

listen to a baseball game in your computer and I just thought to myself, dooooes radio ring a bell”

(sarcastic tones in full swing).

I’m not quite sure how Bill Gates continues to smile throughout this exchange while TV man casually mocks his life’s work in front of a cackling audience.

Given it was 1995, I think Mr Letterman’s ignorance can be forgiven – after all - DVDs were still a whole 2 years away from inception at the time of them speaking.

But if we’re to judge Zuckerberg on his ability to integrate new technology into our daily living, then very rarely does he miss – one third of the planet now uses a Zuckerberg owned product in their day-to-day living.

Shockingly, I thought this figure would be higher which is testament to Zuckerberg’s stranglehold.

Total Addressable Market

The million-dollar (Trillion dollar, Shirley?) question on everyone’s lips. And on this occasion, I’ll have to phone a friend because, to be quite frank, I certainly don’t have the expertise or time to sit here to tot up what I think the metaverse is might be worth in cold hard dollars. Or NFTs… QR codes and Bitcoins as I’m sure it will be in the not-too-distant future.

Thankfully, a very smart chap at Morgan Stanley (Brian Nowak, Managing Director and consumer internet specialist) has taken to this task and come up with a figure of $8 trillion. Crikey.

Brian Nowak further notes: “The metaverse is most likely to be a next-generation social media, streaming and gaming platform. And like current digital platforms, we expect the metaverse to initially and primarily operate as an advertising and e-commerce platform for offline products/purchases.”

Testament of this can be found whenever a nebulous whisper of an Apple produced VR headset does the rounds… oooooh, is Apple joining the metaverse race..? A further $100bn is then quickly heaped onto their already bulging market capitalisation.

Valuation

Now for the good part. The part which first caught my eye when searching for a high growth bargain.

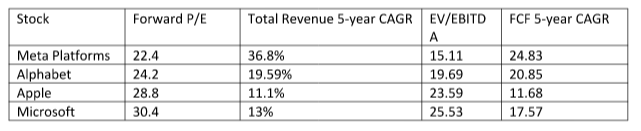

Whichever way you look at it, there’s a clear pricing anomaly between Meta Platforms and its other meta peers. I could have thrown in other metaverse related companies such as Snap and Roblox, but to be completely honest, they’re not even in the same league in terms of size and cash position – so I’ve stuck with the main players for this comparison.

Just on a basic forward earnings multiple, they’re the cheapest. Factor in debt for an Enterprise Value/EBITDA and they still come out best. Not only that, they’re (by far) producing the most top-line revenue growth and have been growing their free-cashflow at the quickest rate, too.

Now, the quoted Total Revenue CAGR figure of 36.8% is based on historic data and doesn’t look at their forecast revenue growth over the foreseeable future. Looking ahead from the last trailing four quarters to their 2022 full year, they’re estimated revenues will continue to climb an impressive 24.67%.

The only concern here, is why is it so cheap…? Seems almost suspiciously cheap and I’m getting flashbacks of some of the ill-advised purchases made over my lifetime.

Their public image and reputation might lend a helping hand on this front.

Image & Reputation

Cambridge Analytica, privacy issues, the whistle-blower, Apple’s edifying stance on data harvesting and the fact that Mark himself doesn’t exactly come across as the warmest of humanoids doesn’t help matters either.

*I think someone’s had a bit too much data for one lifetime, young man

The various issues usually stem from Meta Platforms’ transparency as to how they’re monetising people’s data and user’s awareness (or lack of).

There’s been multiple instances of Meta Platforms mis-treating data, like when it famously sent unsolicited emails to users’ contacts when they joined the social network. This later resulted in a fine of €100K (Facebook were producing at least this, in revenue, every 2 minutes at the time of the fine – so they just about survived).

The difficulty is, Meta Platforms work for the advertiser and that conflict of interest will never cease to exist. The clever people over in California are constantly striving to find new and innovative methods to marry up their users’ data with the needs of the advertiser.

Which doesn’t necessarily have to be a bad thing as such, if there’s transparency - targeted ads are now largely accepted by the general public. But in the journey of discovering what’s acceptable and what isn’t, Meta Platforms have too often been on the wrong side of history and the slapped wrists have been plentiful.

The on-going battle between Zuckerberg and his regulators will remain for years to come, I suspect.

However, this shouldn’t be surprising given just how much data Meta Platforms is responsible for.

What’s important is to see a concerted effort from the side of Meta to curtail their legacy issues and move closer towards a working relationship, rather than a battle, with the regulator.

“We know that companies like Facebook have become a part of people’s everyday lives, and that comes with immense responsibilities and a lot of very difficult judgments. We don’t think we should be tackling these issues alone, which is why I’ve called for a more active role for governments and regulators on harmful content, protecting elections, privacy, and data portability.”

Mark Zuckerberg’s at a hearing before the House Financial Services Committee

In March last year, Zuckerberg even released a manifesto outlining core principles that Meta will work towards to rebuild trust which are centred around privacy, encryption, deletion of private content and safety in their manifesto.

Either Mark does truly care about the privacy of his humanoids, or he’s finally realised it’s becoming rather expensive not to. Regardless, the end goal of improving data privacy and Meta’s reputation does appear to be an integral part of their ongoing fight for world domination whether it’s for sincere heartfelt reasons or otherwise (I suspect the latter).

Conclusion

Their legacy issues and poor reputation shouldn’t be ignored and gives a clear explanation as to why there’s such a pricing anomaly between them and the rest of the pack. I can at least understand why they’re out of favour, but the valuation gap, although once justified, completely discounts their ability to improve upon this and passes up their first mover advantage into the metaverse.

In a normal scenario, without any legacy issues or reputational damage, you’d ideally envisage the company with the greatest forward earnings potential to command the highest forward P/E ratio.

Certainly not the case here and maybe therein lies an opportunity.

Their share price may remain pinned back for a little while longer until they’re able to show they can work in harmony with the regulator, but their bold move to reinvent themselves as the pioneer of the metaverse needs to be recognised.

If their metaverse market lead translates into increased earnings and they can keep their nose out of trouble, then their valuation and share price have some catching up to do.

We’re already seeing a swift chain reaction from others after Facebook changed its name and modus operandi. It’s rumoured that the recent acquisition of Activision by Microsoft (for a cool $68bn) was panic buy, with Microsoft concerned that Zuckerberg was already running away with the meta race.

With that $68bn deployment of capital, Microsoft were prepared to pay a 26% premium on Activision’s share price just to keep pace. If this is a state of play amongst the metaverse market, then surely Meta Platforms’ depressed valuation needs some serious consideration for a long-term portfolio buy.

Their Oculus VR hardware already puts Meta in a commanding position to lead the gaming portion of the market and Zuckerberg has verbally committed to spending an additional $10bn a year, to further bolster their metaverse division, for the next decade.

Love it or hate it, big corporations are dictating that society move closer to a virtual existence and for the purpose of this article, I thought I’d get in the spirit and create an avatar of myself…

*My only true loves in life

The sad part was, I deliberately picked out a branded Levis hoodie to make my avatar look a bit trendier. To my surprise, it didn’t cost anything extra in the app store, but I bet my bottom dollar it’s only a matter of time before users’ have to pay an extra fee to kit out their avatar alter ego.

Be under no illusion, buying Meta Platforms is a bet on their ability to clean up their act. If you’re not convinced of this, then maybe Microsoft represents a lower-risk alternative but that comes with a hefty valuation premium.

Or maybe, like David Letterman, you’re just a sceptic and think the metaverse is all nonsense, in which case best of luck to you.

For me however, it’s taking a firm top spot on my watchlist.

If you’ve enjoyed this article and want to start your investing journey, feel free to reach out to me personally on t.sunderland@mittomarkets.com or call 0208 159 8985

Important Notice: When investing in shares, your capital is at risk. The value of the investment and any income from it can fall as well as rise, so you may get back less than your original investment.