Tim You Absolute Meanie, You!

As I’ll be lifting the lid on the nation’s beloved J D Wetherspoons, it’s only right that you know I’ve had a handful of beers whilst writing this. It’s fitting if nothing else, right?

So, without further ado, lets chat about pubs! More specifically, J D Wetherspoons.

For my non-UK readers who haven’t experienced a Wetherspoons pub, it’s a rather special place filled with an utterly eclectic crowd. Rock-bottom prices catering for both the under-aged students who send their tallest mate to the bar (hoping not to get ID’d) and the the old fellas collecting their state pension just wanting to bask in the evanescence of their former youthful selves. It’s quite a hoot as it approaches closing time.

Young and old gather round a colourful well-lit machine hoping to enrich their wealth. Words are spoken, never to be repeated the next day. “I bet you a tenner you can’t pull that girl” and such.

So yes, J D Wetherspoon.

Run by a bloke who’d comfortably pass as one of the locals, Tim Martin.

Me and Tim Martin share the same name, but unlike Mr Martin, I’m not a complete meanie! You see, depending on which paper you read, Tim Martin is actually Mr Scrooge.

Tight fisted and god forbid, a Brexiteer (I personally don’t care which way he votes for the record)!

To give a little background, Tim Martin initially received furious backlash after not offering his staff the government’s furlough pay scheme which covers up to 80% of their normal wages (not sure why he didn’t in the first place, but that’s a whole other debate!). Hence, he is Mr Scrooge.

Now onto the serious bit. Investing and more importantly, is it time to look at the battered pub stocks?

The dreaded ‘rona wiped out the hospitality industry almost overnight. Hotels, pubs, zoos, the lot!

It’s a very sad reality which caused real people to lose real jobs and make real businesses go under.

Even one of my beloved local pubs in Putney is no more, and this fate isn’t uncommon for pubs which aren’t owned by a large brewery.

And with this terrible set of unfortunate circumstances, lies opportunity for the greedier minded. I say greedier - but actually, I think that’s unfair. There will always be somebody ready to capitalise from an unfortunate circumstance, so it may as well be you!

I’m not an advocate of ‘bargain hunting’ when it comes to buying stocks. I’m usually of the opinion that if a share price has crashed, it’s crashed for a very good reason. They’re normally cheap for a reason, and that reason is often because they’re crap. Trust me, I’ve ploughed thousands of pounds of my own money chasing rubbish companies down to the bottom – offering up my fortunes to the short seller on the other side.

However, that’s not to say some of those companies can’t lift themselves from the canvas like a miraculous Tyson Fury second coming.

EasyJet, Rolls Royce, J D Wetherspoon all suffered this terrible fate. But there comes a time when you need to ask yourself, will they remain on the heap forever?

Not necessarily is the short answer. I’ve stayed away from the likes of EasyJet and Rolls Royce simply because their monstrous and relentless monthly cash burn scares me. The rent and minimum wage staff of ‘Spoons is a different gravy compared to the aforementioned. Plus, it’s a business model which is more comprehensible to the average investor. In other words…

So back to crushed industries.

As normal day-to-day idiots who don’t know a great deal about the stock market, we can be sure of one thing. Buy low and sell high – that’s the dream. Following on from this sentiment, we want to buy something which is down but not going to go bust, hopefully…

And that leads me nicely to the pubs. Something which is inherent to the very fabric of UK culture.

We will return to the pubs, fact. It’s up there with death and taxes in terms of certainties.

And if you’re looking for a stock to potentially buy, then finding value in a beaten-up pub isn’t a bad shout. The question is, which pub will survive this onslaught of tier 1, 2 and 3 lockdown rules?

I always try and think along the following lines – would I put my sister’s money into this? And with that process comes one big question…

Will the company in question go bankrupt?

Ultimately if pubs in the UK cease to exist, then that’s the day I sign up to Dignitas, give up this stockbroking gig and throw the entrepreneur books into the bonfire. And with that, surely one listed pub stock has to rise from the ashes and swallow up the competition?

Like any pub in the UK, the outlook isn’t exactly cheery in the short-term. Let’s be honest. So, it’s important to differentiate between the ones who may legitimately go under vs the ones who will make it through these trying times.

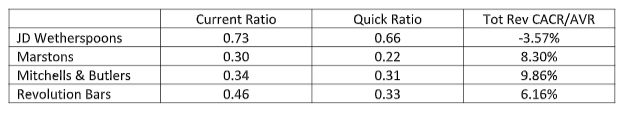

A couple of metrics I like to reference in this scenario are Quick Ratio and Current Ratio, which determine how well placed a company is to pay their short-term liabilities… How much beer, crisps, pork scratchings and cash have they got vs liabilities due inside of 12 months is what we’re trying to work out.

Current ratio = beer + pork scratchings + crisps + blue lagoon cocktail jugs + cash / money owed inside of 12 months

Quick ratio = cash + cash like items / money due within 12 months

Any less than one, then it’s time to buck up your ideas. More than 1 then you’re, in theory, cooking on gas. Trading for Dummies by Tim Sunderland.

Don’t bother with those FX Lifestyle courses on Instagram, I got you covered pal.

I’ll be honest, J D Wetherspoon isn’t exactly a shining beacon of hope in terms prosperity and cash reserves. But compared to their peers, they’re the Angel Gabriel!

*Quick fact - I played the Angel Gabriel in the primary school nativity play and smashed my role! Still waiting on my Spielberg feature follow up… Not sure if you needed to know that, but here we are and such is life.*

With that, I think it’s time to have a health check as to who can survive the pandemic;

Looking at that table, like I said they’re not exactly brimming with a gold star unconditional offer to go straight into the main FTSE 100 index, but they’re doing a helluva lot better than their peers!

I tried to delve into their credit rating from the main rating agencies such as Standard & Poor’s, Fitch and Moody’s but J D Wetherspoons doesn’t come under their scope. Not because they’re a credit risk of any sort necessarily, simply because their scope doesn’t reach them - as with other said pubs.

And with J D Wetherspoon I’m comforted in seeing they’re better positioned to meet their short-term liabilities, lay claim to one of the most recognisable brands in the UK and have stood the test of time over multiple recessions.

It may be argued that when times are particularly tough, the nation will seek more pint for their pound, in which case J D Wetherspoon is by far the market leader.

Vital income streams from university students and state pensions receivers remain constant, the same can’t be said for the middle class.

This write up is less about identifying a pub with the lowest forward P/E ratio and highest top-line revenue projections and more about determining who exactly will survive this horrendous drop-off in foot-fall.

Many pubs will go bust unfortunately, but in this sad business cycle we find ourselves in there will also be a pub (or pubs) who’ll sweep up the market share. Expand and flourish to be bigger and better than before. And if incomes are depressed, will the middle class seek out the likes of a J D Wetherspoon?

Could J D Wetherspoon pick up the slack of defunct independent pubs and small chains who can’t cope?

They’re certainly in a better position to do so vs Revolution Bars, Marstons and Mitchells & Butlers for a start.

And so it stands, if you’re willing to take a punt on Mr Wetherspoon (and not one of his slot machines!), you could find yourself in the enviable position of not having to drink in one of his pubs.

I must stress however; this is a long-term view and is only my opinion and should not be considered advice.

If you’ve enjoyed this article and want to start your investing journey, feel free to reach out to me personally on t.sunderland@mittomarkets.com or call +44 (0)208 159 8985

Important Notice: When investing in shares, your capital is at risk. The value of the investment and any income from it can fall as well as rise, so you may get back less than your original investment.